Hedging forex is a widely used strategy by traders to minimize risk and protect their investments. In this article, we will provide you with a detailed understanding of “hedging forex” and how it can be employed effectively in the volatile foreign exchange market.

What is Hedging Forex?

Hedging forex refers to the practice of taking offsetting positions in the forex market to protect against potential losses. It involves opening two or more positions that have a negative correlation with each other, which means that if one position incurs losses, the other position should offset those losses to a certain extent.

Hedging is often employed by traders to manage risk and provide a level of insurance against adverse market conditions. It allows traders to protect their open positions and investments from unexpected market movements.

Types of Hedging Strategies

There are several hedging strategies that traders can utilize in forex trading. Here are some common types:

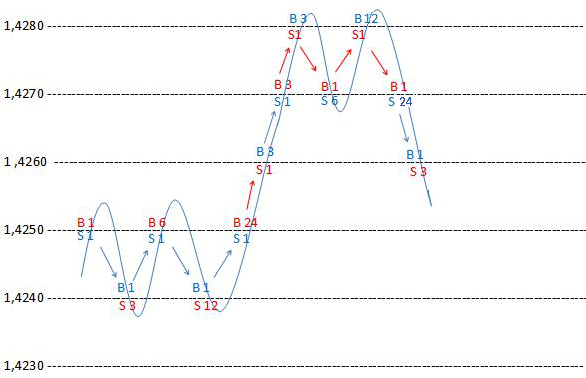

- Simple Forex Hedging: This strategy involves opening a buy and a sell position on the same currency pair simultaneously. By doing so, any losses incurred in one position can be offset by the gains in the other position, thus minimizing the overall risk exposure.

- Multiple Currency Pair Hedging: In this strategy, traders hedge their positions by opening positions in multiple currency pairs that are positively or negatively correlated.

- Options Hedging: Options contracts can also be used for hedging purposes. Traders can purchase put options to protect their long positions or call options to protect their short positions. Options provide traders with the right, but not the obligation, to buy or sell a currency pair at a predetermined price within a specified time frame.

Pros and Cons of Hedging Forex

Like any trading strategy, hedging forex has its own set of advantages and disadvantages. Let’s explore them in detail:

Pros:

- Risk Mitigation: Hedging allows traders to minimize the impact of adverse market movements and protect their investments from potential losses.

- Portfolio Diversification: By employing various hedging strategies, traders can diversify their portfolio and reduce the overall risk exposure.

- Flexibility: Hedging strategies can be customized to suit individual trading styles and risk tolerance levels.

Cons:

- Complexity: Hedging strategies can be complex and require a deep understanding of market dynamics and correlation analysis.

- Costs: Implementing hedging strategies may involve additional costs, such as spreads, commissions, or options premiums.

- Reduced Profit Potential: While hedging aims to minimize losses, it can also limit potential profits as gains in one position may be offset by losses in the other position.

Implementing Hedging in Forex Trading

To effectively implement hedging in forex trading, traders should consider the following steps:

- Identify the Risk: Analyze the market conditions and identify the potential risks that may affect your trades, such as currency volatility or geopolitical events.

- Select the Suitable Hedging Strategy: Choose the appropriate hedging strategy based on your risk tolerance, trading style, and market analysis.

- Execute the Hedge: Open the hedge positions according to the selected strategy, ensuring that the positions have a negative correlation to provide the desired risk protection.

- Monitor and Adjust: Regularly monitor the market conditions and make necessary adjustments to your hedging positions as needed. Market dynamics may change, requiring you to modify or close your hedge positions.

Conclusion and Suggestions

Hedging forex can be a valuable tool for managing risk and protecting investments in the dynamic foreign exchange market. It allows traders to minimize potential losses and maintain a level of stability in their trading portfolios. However, it is important to note that hedging is not a foolproof strategy and does not guarantee profits. Traders should thoroughly understand the concept of hedging, carefully assess its suitability for their trading goals, and implement it with proper risk management.

It is recommended to practice hedging strategies in demo accounts before applying them in real trading. Additionally, staying updated with market news, economic indicators, and geopolitical events can help traders make informed decisions regarding their hedging strategies.