Are you interested in maximizing your profits in the forex market? If so, then the forex scalping strategy might be just what you’re looking for. In this article, we will explore what Forex Scalping Strategy is, how it is used, and provide some useful tips to help you implement this strategy effectively.

Understanding Forex Scalping

Forex scalping is a trading strategy that aims to make small and frequent profits by entering and exiting trades within short time frames. It involves taking advantage of small price movements in the market and exploiting them for gains. Scalpers typically hold their positions for a few seconds to minutes, aiming to capture quick profits.

How It Is Used

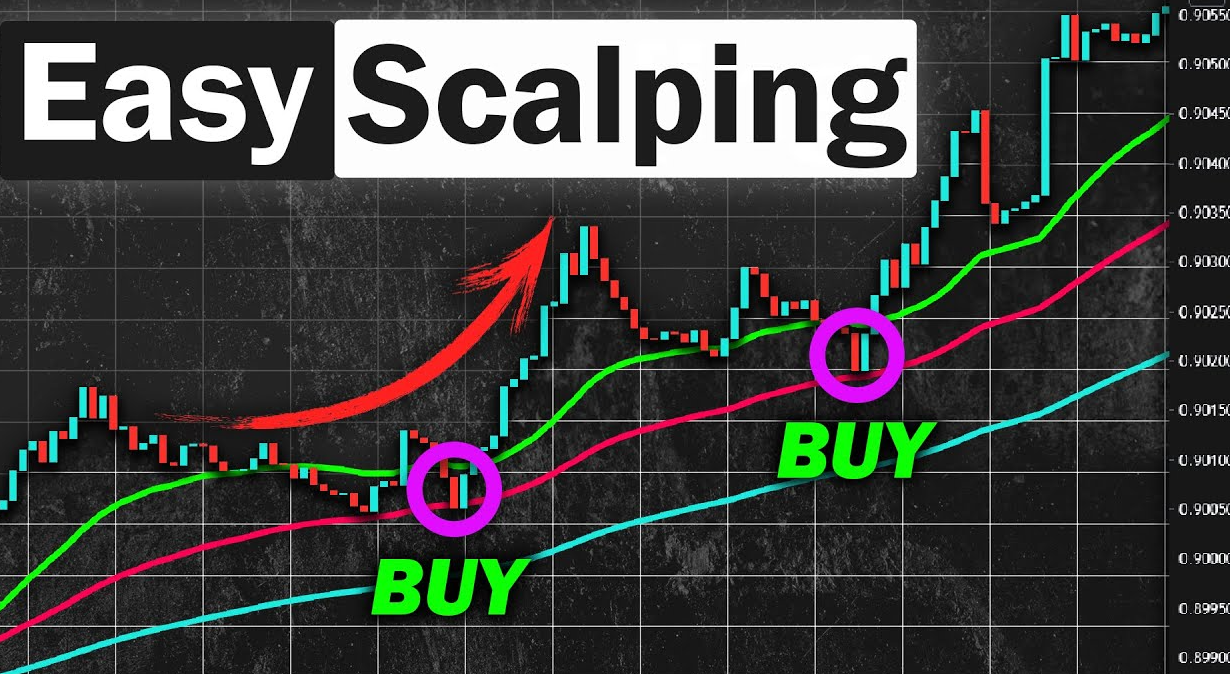

The forex scalping strategy is primarily used by active traders who can closely monitor the market and execute trades swiftly. It requires a high level of focus, discipline, and the ability to make quick decisions. Scalpers often rely on technical analysis tools, such as chart patterns and indicators, to identify potential entry and exit points.

Tips for Implementing Forex Scalping Strategy

To effectively implement the forex scalping, consider the following tips:

- Choose liquid currency pairs: Focus on trading the most actively traded currency pairs, as they tend to have lower spreads and higher liquidity.

- Define clear entry and exit rules: Develop a set of rules to determine when to enter and exit trades. This could be based on specific technical indicators, price levels, or a combination of factors.

- Manage your risk: Set strict stop-loss orders to limit potential losses and adhere to them. Scalping involves taking multiple trades, so it’s essential to manage risk effectively to avoid significant drawdowns.

- Use leverage wisely: While leverage can amplify profits, it can also increase losses. Be cautious when using leverage and only trade with an amount you can afford to lose.

- Practice and refine: Like any trading strategy, forex scalping requires practice to master. Start with a demo account to gain experience and fine-tune your approach before trading with real money.

Conclusion

Forex scalping is a popular strategy among active traders who aim to profit from short-term price fluctuations in the currency markets. By understanding how it is used and implementing it effectively, traders can potentially take advantage of quick opportunities for profit. However, it’s important to note that forex scalping is a high-risk strategy that requires careful risk management and constant monitoring of the market.

In conclusion, the forex scalping can be a powerful tool for traders looking to capitalize on short-term price movements in the forex market. By understanding the principles behind this strategy and implementing it with discipline and proper risk management, traders can potentially generate consistent profits.

Suggestion: If you are considering implementing the forex scalping , it is recommended to start with a small trading account or use a demo account to familiarize yourself with the dynamics of scalping. Additionally, staying updated with market news, economic indicators, and technical analysis can help you make informed trading decisions. Remember to be patient, as mastering the forex scalping strategy may take time and experience. Good luck with your trading journey!