If you’re a Maryland resident looking for the best car insurance rates, you may be wondering where to start. The good news is, comparing car insurance quotes in Maryland is easy and can save you money on your insurance premiums. In this article, we’ll take a closer look at how you can compare car insurance quotes Maryland to find the best coverage for you and your vehicle.

Compare Car Insurance Quotes Maryland

It’s important to understand that car insurance rates can vary greatly depending on a number of factors, including your driving record. That’s why it’s so important to compare rates from different insurance providers to make sure you’re getting the best deal.

Determine Your Coverage Needs

Before you start comparing rates, it’s important to determine your coverage needs. This means deciding what type of coverage you need, such as liability insurance, comprehensive coverage, collision coverage, and more.

It’s also important to think about how much coverage you need. For example, if you have a brand new car, you may want to consider getting more coverage to protect your investment. On the other hand, if you have an older car that’s not worth much.

Get Quotes from Multiple Insurance Providers

Once you’ve determined your coverage needs, it’s time to start getting quotes from multiple insurance providers. This can be done online, over the phone, or in person.

When getting quotes, be sure to provide the same information to each insurance provider so that you can accurately compare rates. This information may include your driving record, the make and model of your vehicle, and your age and location.

Compare Coverage and Rates

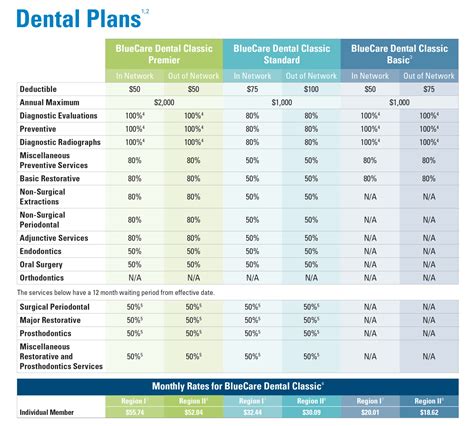

Once you’ve received quotes from multiple insurance providers, it’s time to compare the coverage and rates. This means looking at what each insurance provider is offering and how much it will cost.

When comparing coverage, be sure to look at the type of coverage each insurance provider is offering and make sure it meets your coverage needs. When comparing rates, be sure to look at the total cost of the coverage, including any deductibles, fees, and taxes.

Choose the Best Option

Once you’ve compared the coverage and rates from multiple insurance providers, it’s time to choose the best option. This means deciding which insurance provider offers the best coverage at the best price.

It’s also important to read the fine print and make sure you understand the terms. Make sure you understand what is covered, what is excluded, and what the policy limits are.

Conclusion

Comparing car insurance quotes in Maryland is a great way to find the best coverage for your vehicle and budget. By determining your coverage needs, getting quotes from multiple insurance providers, comparing coverage and rates, and choosing the best option.

Suggestion

It’s recommended to compare car insurance rates at least once a year to ensure that you’re still getting the best deal. Additionally, if you make any major changes to your life or vehicle, such as getting married, having a baby, or buying a new car.Remember, car insurance is an important investment, so take the time to compare rates and choose the best coverage for you and your vehicle.