Are you looking for a way to protect your trading profits and minimize your exposure to risk in the forex market? If so, then a forex hedging strategy might be just what you need. In this comprehensive guide, we’ll take a closer look at what a Forex Hedging Strategy is and how it can be used to enhance your trading success.

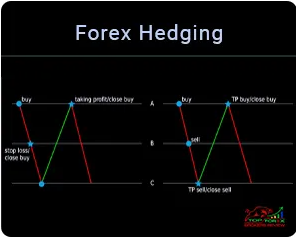

Forex hedging refers to a trading strategy that involves opening two or more positions in different currency pairs with the goal of offsetting the potential losses from one position with the potential gains from another. This can help to reduce your overall exposure to risk and protect your trading profits, even in volatile market conditions.

How to Implement a Forex Hedging Strategy

Implementing a forex hedging strategy can seem overwhelming at first, but it’s actually quite simple once you understand the basics. Here are the steps you’ll need to follow:

- Determine your primary trading strategy. This will involve analyzing the market and making decisions about when to enter and exit trades based on your analysis.

- Open two or more positions, one in your primary currency pair and one in the currency pair you’re hedging against. The goal is to offset any potential losses from your primary position with the potential gains from your hedging position.

- Monitor both positions and adjust your hedging strategy as needed. This may involve closing one or both positions, adjusting the size of your positions.

Benefits of a Forex Hedging Strategy

There are many benefits to using a forex hedging , including:

- Reduced exposure to risk. By offsetting the potential losses from one position with the potential gains from another.

- Improved risk management. A well-designed forex hedging can help you manage your risk more effectively and make more informed trading decisions.

- Greater flexibility. With a forex hedging in place, you can adjust your positions and respond to market changes more quickly and effectively.

Conclusion and Suggestions

In conclusion, a forex hedging strategy can be a valuable tool for protecting your trading profits and minimizing your exposure to risk in the forex market. By following the steps outlined in this guide and implementing a well-designed hedging.

However, it’s important to keep in mind that no hedging is foolproof and there are always risks involved in forex trading. As such, it’s crucial to stay up-to-date with the latest market news and developments and to continually refine your hedging strategy based on your analysis and experience.

So why not give forex hedging a try? With the right approach and a bit of luck, you could be well on your way to success in the foreign exchange market.