Forex, or foreign exchange, trading is the process of buying and selling currencies in order to profit from the fluctuating exchange rates. Forex trading can be a lucrative way to invest your money, but it can also be risky if you don’t know what you’re doing. In this guide, we will cover the basics of how to trade forex.

Understanding Forex

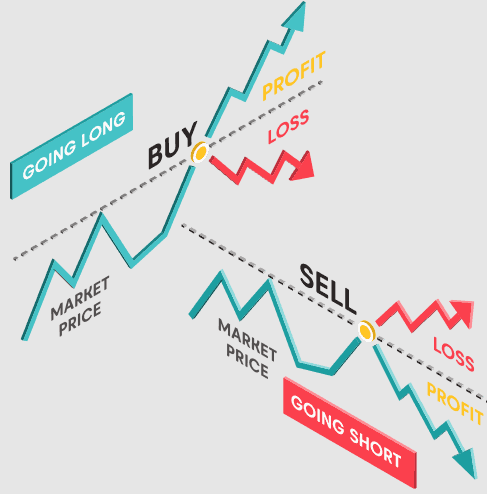

Before you start trading forex, it’s important to have a basic understanding of How to Trade Forex. Forex trading involves buying and selling currencies in pairs, such as the EUR/USD or GBP/JPY. When you buy a currency pair, you are buying the base currency and selling the quote currency.

Forex trading takes place in the global currency market, which is open 24 hours a day, five days a week. The market is decentralized, meaning that there is no single exchange where all trades take place. Instead, forex trading is conducted electronically over-the-counter (OTC) through a network of banks and brokers.

Choosing a Forex Broker

One of the first steps to trading forex is to choose a reputable forex broker. A forex broker is a company that provides traders with access to the forex market. When choosing a forex broker, consider factors such as regulation, fees, trading platforms, customer support, and available trading instruments.

Make sure to choose a broker that is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. This ensures that the broker meets certain standards and protects your funds.

Developing a Trading Plan

Developing a trading plan is essential for success in forex trading. A trading plan is a set of rules and guidelines that you follow when trading, such as when to enter and exit trades, how much to risk per trade, and what trading strategies to use.

When developing a trading plan, consider factors such as your trading goals, risk tolerance, and trading style. It’s important to have realistic expectations and to stick to your plan, even when emotions are running high.

Mastering Technical Analysis

Technical analysis is the study of past market data, such as price and volume, in order to predict future market movements. By mastering technical analysis, you can identify trends and patterns in the market and make informed trading decisions.

There are many technical indicators and tools that you can use to analyze the market, such as moving averages, trend lines, and oscillators. However, it’s important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis, such as fundamental analysis.

Managing Risk

Managing risk is an essential part of forex trading. No matter how well you analyze the market, there is always a risk of losing money. To minimize your risk, it’s important to have a solid risk management plan in place.

One way to manage risk is to use stop-loss orders. A stop-loss order is an order to close a trade at a specific price, which helps limit your losses if the market moves against you. Another way to manage risk is to use proper position sizing, which involves calculating the appropriate amount to invest in each trade based on your account size and risk tolerance.

Continuing Education and Practice

Forex trading is a complex and ever-changing field. To stay ahead of the game, it’s important to continue your education and practice regularly. Attend webinars and seminars, read trading books and articles, and practice trading on a demo account before risking real money.

By following these tips and continuously learning and practicing, you can improve your chances of success in forex trading.

Conclusion

Forex trading can be a profitable way to invest your money, but it’s important to approach it with caution and a solid understanding of the market. By choosing a reputable forex broker, developing a trading plan, mastering technical analysis, managing risk, and continuing your education and practice, you can improve your chances of success in forex trading.

Suggestion

Always remember to approach forex trading with discipline and patience. Don’t let emotions take over, and stick to your trading plan. Take small steps and aim for consistency rather than trying to hit a home run with every trade. With time and practice, you can become a successful forex trader.