ECN Forex Brokers, a key term in the world of currency trading, can be your game-changer. In the first two paragraphs, we’re going to dive deep into understanding what these brokers are, and how they can be used to your advantage.

What is an ECN Forex Broker?

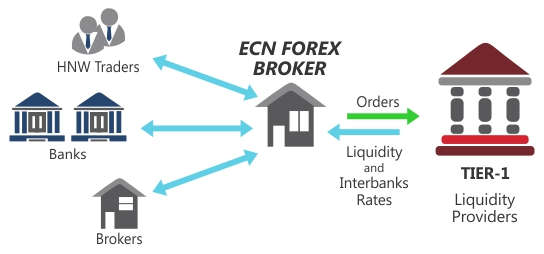

An ECN Forex Broker is essentially a type of forex broker that uses an Electronic Communications Network (ECN) to provide its clients with direct access to other participants in the forex market. It is quite different from traditional brokers because it operates without a dealing desk. This means that trades are processed in an automated manner and directly matched with liquidity providers or the best available prices from other market participants.

How is an ECN Forex Broker used?

An ECN Forex Broker is typically used by traders for executing high-speed trades and getting access to real-time quotes and a transparent trading environment. They offer a platform where traders can see where the liquidity is and execute trades accordingly. This allows traders to compete with each other, leading to tighter spreads and less price manipulation.

Advantages of ECN Forex Brokers

Transparency

ECN Forex Brokers provide an unparalleled level of transparency compared to traditional forex brokers. This is because orders are executed at the best possible prices available from liquidity providers. Moreover, traders can also see the actual market depth.

Speed of Execution

ECN Forex Brokers usually offer high-speed trade execution. This is particularly beneficial for scalpers and day traders who capitalize on small price movements within a single trading day.

No Dealing Desk

With no dealing desk, there is no broker intervention. Trades are automatically matched with the best available prices, which can be beneficial for traders who prefer automated trading strategies.

Considerations when Choosing an ECN Forex Broker

Commission Rates

ECN Forex Brokers often charge a commission on trades. It’s vital to understand these charges and how they might affect your trading profitability.

Regulation

Consider whether the broker is regulated by a reputable authority. Regulatory bodies ensure that brokers operate within set rules and procedures, providing traders with a level of protection.

Available Trading Tools

Check out the trading tools and resources the broker provides. These can range from news feeds, charts, and technical analysis tools which can be critical in making informed trading decisions.

Conclusion and Suggestions

Engaging with an ECN Forex Broker can open up a whole new world of forex trading for you. It offers numerous benefits such as transparency, high-speed trade execution, and no dealing desk intervention. However, it’s important to consider factors such as commission rates, regulation, and the available trading tools before choosing an ECN Forex Broker.

My suggestion for those looking to dive into the forex market would be to start slow. Familiarize yourself with the basics, then gradually move onto understanding the more complex aspects such as ECN. Always remember, in forex trading, knowledge is power. So equip yourself with it and tread with caution.