Forex volatility plays a crucial role in the currency exchange market. Understanding how it is used and its implications is essential for traders and investors alike. In this article, we will explore the concept of forex volatility, its impact on market dynamics, and strategies to navigate through its fluctuations. Whether you’re a seasoned trader or a beginner, comprehending forex volatility will empower you to make informed decisions and potentially capitalize on market movements.

What is Forex Volatility?

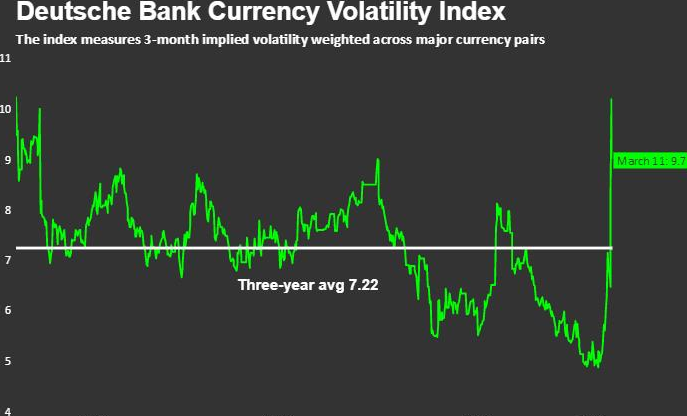

Forex volatility refers to the degree of variation and fluctuations in currency exchange rates over a certain period. It measures the rate at which the prices of currency pairs change. Volatility is influenced by various factors, including economic indicators, geopolitical events, market sentiment, and trading volumes. Higher volatility indicates larger price swings, providing potential opportunities for profit but also higher risk.

The Impact of Forex Volatility

Forex volatility has significant implications for traders and the overall market:

- Opportunity for Profits: High volatility can offer traders opportunities to profit from price movements. Rapid price fluctuations create chances to enter and exit trades at favorable levels and potentially generate substantial profits.

- Increased Risk: Volatile markets also come with increased risk. Sudden and large price swings can lead to substantial losses if trades are not managed properly. Traders must employ risk management strategies, such as setting stop-loss orders and implementing proper position sizing, to mitigate the risks associated with volatility.

- Market Liquidity: Volatility often leads to increased market liquidity, as more participants are drawn to capitalize on price movements. Higher liquidity can result in improved trade execution, tighter spreads, and increased trading volumes.

- Impact on Trading Strategies: Forex volatility influences the effectiveness of different trading strategies. Some strategies, such as breakout trading or momentum trading, thrive in volatile conditions, while others, like trend-following strategies, may struggle to generate consistent profits. Traders must adapt their strategies to the prevailing volatility levels.

Strategies for Navigating Forex Volatility

To navigate forex volatility successfully, traders can employ various strategies:

- Use Volatility Indicators: Utilize technical indicators specifically designed to measure and track volatility, such as Average True Range (ATR) or Bollinger Bands. These indicators provide valuable insights into market volatility levels and can help identify potential entry and exit points.

- Implement Risk Management: Proper risk management is crucial during volatile market conditions. Set stop-loss orders to limit potential losses, avoid overexposure by managing position sizes, and use appropriate leverage. Diversify your portfolio to spread the risk and consider using hedging strategies to mitigate potential losses during periods of high volatility.

- Stay Informed: Stay updated with economic news, geopolitical events, and market developments that can impact currency volatility. Monitor central bank announcements, economic data releases, and political developments to anticipate potential market movements and adjust your trading strategies accordingly.

- Adapt Your Trading Style: Adjust your trading approach to suit different volatility conditions. In high volatility environments, consider shorter-term trading strategies that capitalize on price fluctuations. During low volatility periods, focus on longer-term trends and position yourself for potential breakout opportunities.

- Use Stop-Loss and Take-Profit Orders: Set stop-loss orders to limit potential losses and take-profit orders to secure profits. These orders help manage your trades effectively and remove emotions from the decision-making process.

- Practice with Demo Accounts: Before trading in a live environment, practice your strategies and test different approaches using demo accounts. Demo accounts allow you to experience market volatility without risking real money and provide an opportunity to refine your trading skills.

Conclusion

Forex volatility is an integral part of the currency exchange market. Understanding its impact and employing appropriate strategies to navigate through its fluctuations is essential for successful trading. By recognizing the opportunities and risks associated with volatility, adapting your strategies, and implementing effective risk management techniques, you can position yourself for potential profits while mitigating potential losses.

Suggestion

Here are some suggestions to effectively navigate forex volatility:

- Educate Yourself: Continuously educate yourself about the forex market, volatility indicators, and risk management strategies. Stay updated with market news and developments to make informed trading decisions.

- Keep a Trading Journal: Maintain a trading journal to record your trades, including entry and exit points, reasons for trade decisions, and lessons learned. Regularly review your journal to identify patterns and improve your trading approach.

- Seek Guidance: Consider seeking guidance from experienced traders or mentors who have successfully navigated volatile markets. Their insights and experiences can provide valuable guidance and help you avoid common pitfalls.

- Be Patient and Disciplined: Forex volatility can be unpredictable, and not every trade will be profitable. Be patient, stick to your trading plan, and avoid impulsive decisions driven by emotions.

- Continuous Improvement: Forex trading is a journey of continuous learning and improvement. Regularly evaluate your performance, identify areas for growth, and strive to enhance your trading skills over time.

Remember, forex volatility can present both opportunities and risks. By understanding its nature, employing effective strategies, and continuously refining your trading approach, you can navigate through volatile market conditions with confidence and potentially achieve success in the forex market.