If you’re a driver in Fort Collins, Colorado, car insurance is a must-have. Not only is it required by law, but it also provides financial protection in case of an accident or other damages. In this article, we’ll cover everything you need to know about Car Insurance in Fort Collins, Colorado, including coverage requirements, average rates, and tips for finding the right policy.

Colorado Car Insurance Requirements

Like most states, Colorado requires drivers to have liability insurance. Liability insurance covers damages and injuries to other people and their property if you are at fault in an accident. The minimum liability coverage requirements in Colorado are:

- $25,000 for bodily injury or death per person

- $50,000 for bodily injury or death per accident

- $15,000 for property damage per accident

It’s important to note that these are just the minimum requirements, and you may need additional coverage to fully protect yourself and your vehicle.

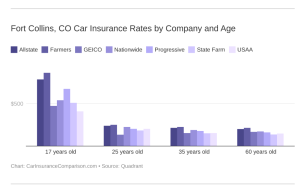

Average Car Insurance Rates in Fort Collins, Colorado

The average car insurance rate in Fort Collins, Colorado, is $1,114 per year for minimum liability coverage and $2,228 per year for full coverage, according to a report by Value Penguin. However, your actual rates may vary depending on factors such as your age, driving history, and the type of car you drive.

Finding the Right Car Insurance Policy

When shopping for car insurance in Fort Collins, Colorado, there are a few things to keep in mind to find the right policy:

Compare Quotes from Multiple Insurance Providers

Comparing quotes from multiple insurance providers is one of the best ways to find the right policy at an affordable price. Make sure to consider factors such as coverage options, deductibles, customer service, and financial stability when comparing quotes.

Consider Coverage Options

When choosing a car insurance policy, consider the coverage options available. In addition to liability coverage, you may need additional coverage such as:

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

Consider your needs and budget when choosing coverage options.

Take Advantage of Discounts

Most car insurance providers offer that can help lower your premium. Some common discounts include:

- Safe driver

- Good student di scount

- Bundling discount for multiple policies

- Low mileage discount

Make sure to ask your insurance provider about available and take advantage of them to save money on your premium.

Work with a Local Insurance Agent

Working with a local insurance agent can be helpful in finding the right car insurance policy for your needs. A local agent can provide personalized service and help you navigate the insurance market in Fort Collins, Colorado. They can also help you understand your coverage options and make informed decisions.

Conclusion

Car insurance is a crucial part of responsible driving in Fort Collins, Colorado. By understanding the state’s insurance requirements, comparing quotes from multiple insurance providers, considering coverage options, taking advantage of available, and working with a local insurance agent.

Suggestion

Remember to review your car insurance policy regularly to ensure that it still meets your needs and budget. Also, inform your insurance provider of any changes in your driving habits or circumstances that may affect your coverage. By being proactive about your car insurance policy and taking advantage of available, you can ensure that you have the right coverage at an affordable price.

If you’re a new driver in Fort Collins, Colorado, or just looking to switch insurance providers, take the time to research your options and find the best policy for your needs. By understanding your coverage options, shopping around, and working with a local insurance agent.