Car business insurance is a type of insurance that protects a business from financial losses due to accidents involving company vehicles. This type of insurance is important for businesses that rely on cars, trucks, or other vehicles to carry out their operations, as it can provide coverage for vehicle damage, liability, and more. Car Business Insurance Quotes are estimates provided by insurance providers to help businesses determine how much coverage they need and how much it will cost.

Types of Car Business Insurance

There are several types of car business insurance, each providing different types of coverage. Some common types of car business insurance include:

- Commercial auto insurance: This type of insurance covers damage to company vehicles.

- Hired and non-owned auto insurance: This type of insurance provides coverage for vehicles that are not owned by the company.

- Cargo insurance: This type of insurance covers damage to goods or products being transported by company vehicles.

- General liability insurance: This type of insurance provides coverage for liability claims that may arise from accidents involving company vehicles.

Factors That Affect Car Business Insurance Quotes

Several factors can affect the cost of car business insurance quotes, including:

- The number of vehicles being insured

- The type of vehicles being insured

- Driving records of the employees who will be driving the vehicles

- Amount of coverage needed

- Deductible chosen by the business

- Location and nature of the business

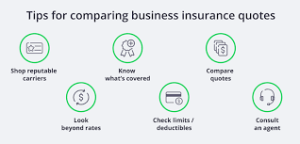

How to Get Car Business Insurance Quotes

Getting car business insurance quotes is relatively simple. Business owners can contact insurance providers directly or work with an insurance agent to get quotes from multiple providers. To get an accurate quote, businesses should be prepared to provide information about their vehicles, drivers, and operations.

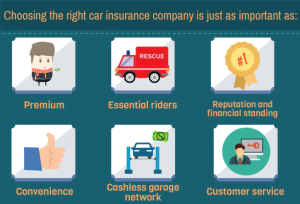

Choosing the Right Car Business Insurance

Choosing the right car business insurance is important for protecting a business from financial losses due to accidents involving company vehicles. When choosing an insurance provider, businesses should consider factors such as the provider’s reputation, customer service, and coverage options. Business owners should also carefully review their policy to ensure that it provides the coverage they need.

The Importance of Working with an Insurance Professional

Choosing the right car business insurance can be a complex and confusing process. Working with an experienced insurance professional can help businesses navigate the process and ensure that they have the coverage they need. Insurance professionals can provide advice on risk management, help businesses identify areas where they can reduce their insurance costs.

Conclusion

Car business insurance is an important type of insurance that can help businesses protect themselves from financial losses due to accidents involving company vehicles. By understanding the types of coverage available, the factors that affect insurance quotes, and the importance of working with an insurance professional. When shopping for car business insurance, it is important for business owners to do their research and compare quotes from multiple providers.