Car insurance is a must-have for drivers in North Carolina. Not only is it legally required, but it can also protect you financially in case of an accident. However, finding the best car insurance deals can be overwhelming. In this article, we’ll be discussing how to compare Car Insurance Quotes NC Comparison and find the best deals.

Car Insurance Quotes NC Comparison

Comparing car insurance quotes in NC is important for several reasons:

- Save money: By comparing quotes from different car insurance companies, you can find the best deals and potentially save hundreds of dollars on your car insurance.

- Get the coverage you need: Comparing quotes allows you to see the coverage options offered by each company and choose the one that best fits your needs.

- Peace of mind: With the right car insurance policy, you can have peace of mind knowing that you’re financially protected in case of an accident.

How to Compare Car Insurance Quotes in NC

Comparing car insurance quotes in NC can be done in a few simple steps:

- Gather your information: Before getting quotes, you’ll need to have your personal information and driving history on hand.

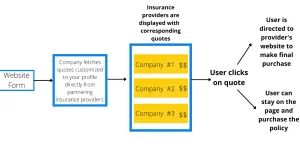

- Get quotes: Visit di fferent car insurance company websites or use a comparison website to get quotes from multiple companies.

- Compare coverage options: Look at the coverage options offered by each company to see which one best fits your needs.

- Compare prices: Compare the prices of the different policies to see which one offers the best value for your money.

- Choose the best option: Once you’ve compared coverage options and prices, choose the policy that best fits your needs.

Factors to Consider When Comparing Car Insurance Quotes in NC

When comparing car insurance quotes in NC, it’s important to consider the following factors:

- Cost: Look for policies that offer the coverage you need at a price you can afford.

- Coverage options: Make sure the policy covers everything you need, including liability, collision, and comprehensive coverage.

- Deductible: Consider the deductible amount and how it will affect your monthly premiums.

- Customer service: Consider the company’s customer service reputation and how easy it is to make a claim.

Conclusion

Comparing car insurance quotes in NC is important for finding the best deals and getting the coverage you need. By gathering your information, getting quotes, comparing coverage options and prices, and considering factors such as cost, coverage options, and customer service, you can find the right car insurance policy for your needs and budget. Don’t be afraid to shop around and ask plenty of questions before making a decision.

Suggestions

If you’re looking to save money on your car insurance in NC, consider increasing your deductible or looking for reduced fare that you may be eligible for. You can also try bundling your car insurance with other types of insurance, such as homeowner’s or renter’s insurance, to save money. When shopping for car insurance, be sure to do your research. Don’t be afraid to ask for reduced fare or negotiate with the insurance company to get the best possible price.