Car insurance is a must-have for drivers in Indiana. Not only is it legally required, but it can also protect you financially in case of an accident. However, finding the best car insurance deals can be overwhelming. In this article, we’ll be discussing how to get the best Car Insurance Quotes in Indiana and find the right policy for your needs.

Why Compare Car Insurance Quotes in Indiana?

Comparing car insurance quotes in Indiana is important for several reasons:

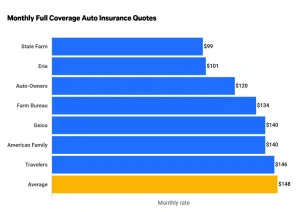

- Save money: By comparing quotes from different car insurance companies, you can find the best deals and potentially save hundreds of dollars on your car insurance.

- Get the coverage you need: Comparing quotes allows you to see the different coverage options offered by each company and choose the one that best fits your needs.

- Peace of mind: With the right car insurance policy, you can have peace of mind knowing that you’re financially protected in case of an accident.

How to Get Car Insurance Quotes in Indiana

Getting car insurance quotes in Indiana is a fairly simple process. Here are the steps you should follow:

- Gather your information: Before getting quotes, you’ll need to have your personal information and driving history on hand.

- Get quotes: Visit car insurance company websites or use a comparison website to get quotes from multiple companies.

- Compare coverage options: Look at the coverage options offered by each company to see which one best fits your needs.

- Compare prices: Compare the prices of the policies to see which one offers the best value for your money.

- Choose the best option: Once you’ve compared coverage options and prices, choose the policy that best fits your needs and budget.

What Factors Affect Your Car Insurance Quote in Indiana?

Several factors can affect your car insurance quote in Indiana, including:

- Age and gender

- Driving record

- Location

- Type of car

- Coverage options

What Coverage Options Are Available for Car Insurance in Indiana?

In Indiana, car insurance policies typically offer the following coverage options:

- Liability coverage: This coverage pays for damages or injuries you may cause to others in an accident.

- Collision coverage: This coverage pays for damages to your car if you’re in an accident.

- Comprehensive coverage: This coverage pays for damages to your car from non-accident related events, such as theft or weather damage.

- Uninsured/underinsured motorist coverage: This coverage protects you if you’re in an accident with someone who doesn’t have enough insurance.

Conclusion

Getting car insurance quotes in Indiana is an important step in finding the right car insurance policy for your needs. By comparing coverage options and prices from multiple car insurance companies, you can find the best policy for your needs and budget. When getting car insurance quotes, be sure to have your personal information and driving history on hand. By doing so, you can get an accurate quote that takes into account all of the relevant factors.

Suggestions

If you’re looking to save money on your car insurance in Indiana, consider increasing your deductible or looking for reduced fare that you may be eligible for, such as safe driver reduced fare, and bundling discounts. You can also try shopping around and comparing quotes from car insurance companies to find the best deals. Be sure to read the terms and conditions of each policy carefully before making a decision. With a little bit of time and effort, you can find a car insurance policy that gives you the protection you need at a price you can afford.