In this article, we’ll take a look at what you need to know about Compare Car Insurance NJ, including the types of coverage available, how to choose the right policy, and how to compare car insurance rates to find the best deal. By following these steps, you can make an informed decision and find the coverage that is right for you.

Compare Car Insurance NJ

If you live in New Jersey, you know that having car insurance is not only required by law, but it also protects you, your vehicle, and others on the road. With so many options to choose from, it can be overwhelming to find the right car insurance policy. That’s why it’s important to compare car insurance in NJ and find the best coverage for your needs and budget.

Types of Car Insurance Coverage Available in NJ

In New Jersey, there are several types of car insurance coverage available, including:

- Liability coverage: This is the most basic type of car insurance coverage and is required by law in NJ. Liability coverage pays for damages and injuries that you cause to others in an accident. It does not cover your own damages or injuries.

- Collision coverage: This type of coverage pays for damages to your own vehicle in the event of an accident. It covers repairs to your vehicle, regardless of who was at fault in the accident.

- Comprehensive coverage: This type of coverage pays for damages to your vehicle that are not caused by an accident, such as theft, fire, or natural disasters.

- Uninsured/underinsured motorist coverage: This type of coverage pays for damages and injuries if you are hit by a driver who does not have insurance or does not have enough insurance to cover the damages and injuries.

How to Choose the Right Car Insurance Policy in NJ

When choosing a car insurance policy in NJ, there are several factors to consider, including:

- Coverage needs: Consider your coverage needs and choose a policy that provides the right amount of protection for you and your vehicle. Make sure to choose a policy that includes liability coverage, as this is required by law in NJ.

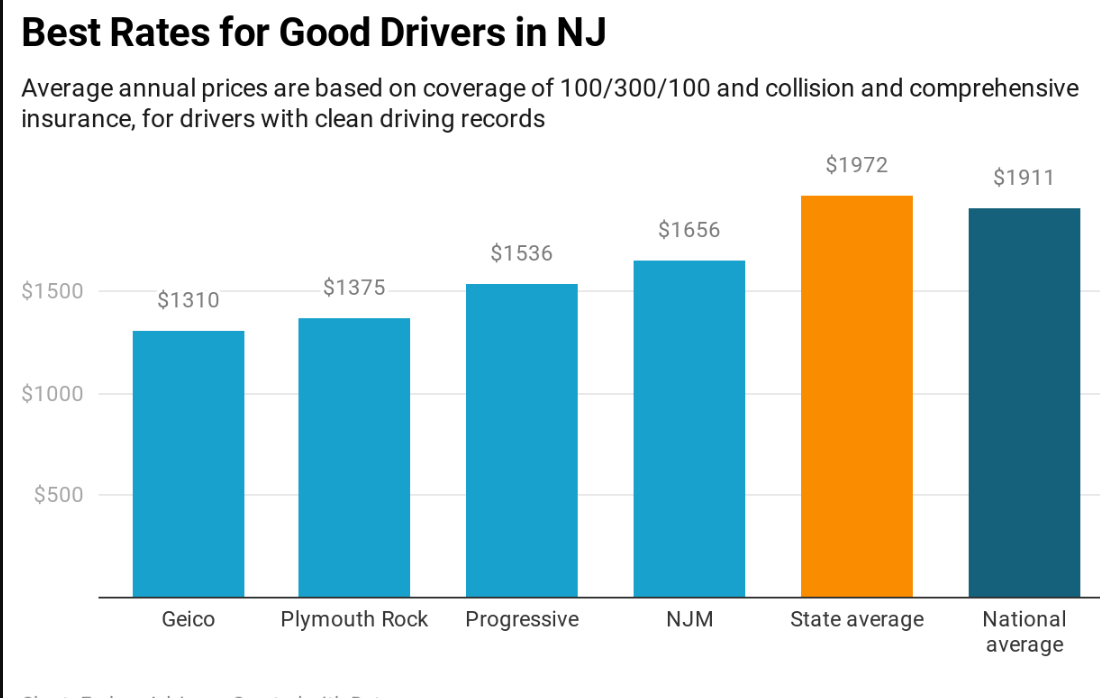

- Cost: Cost is always a consideration when choosing a car insurance policy. Compare quotes from multiple companies to find the best rates for your needs and budget.

- Customer service and claims handling: Check the company’s customer satisfaction ratings to ensure they have a good reputation for customer service. Consider reading online reviews and asking for recommendations from friends and family to get an idea of the company’s customer service and claims handling process.

- Financial stability: Make sure the company you choose is financially stable, as this can impact their ability to pay claims in the event of an accident or other incident. Consider the company’s financial ratings from organizations like A.M. Best and Standard & Poor’s to ensure they are in good financial standing.

How to Compare Car Insurance Rates in NJ

To compare car insurance rates in NJ, consider the following tips:

- Get quotes from multiple companies to compare rates and coverage options.

- Make sure to compare apples-to-apples, meaning compare the same coverage options and deductibles for each quote.

- Ask about discounts for things like good driving record, multiple cars, and safety features on your vehicle.

- Check the company’s financial stability and customer service ratings before making a decision.

Conclusion and Suggestion

In conclusion, comparing car insurance in NJ is an important step in finding the right coverage for your needs and budget. By understanding the types of coverage available, how to choose the right policy, and how to compare car insurance rates, you can make an informed decision and find the best coverage for you.

It is suggested that you take your time and do thorough research when shopping for car insurance in NJ. Don’t be afraid to ask questions and compare quotes from multiple companies to find the best rates. Remember, the right insurance can provide peace of mind and help to protect you and your vehicle in the event of an accident or other unforeseen circumstances.