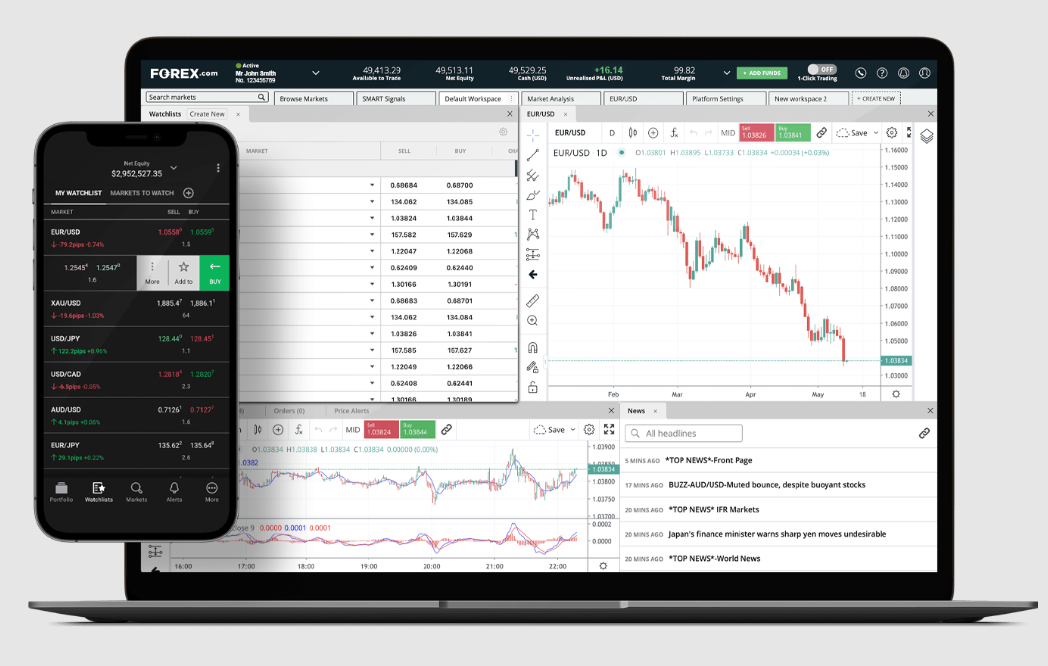

A forex platform is a software application that allows traders to access and trade in the forex market online. It serves as a gateway to the global currency market, providing tools and features for executing trades, analyzing market data, and managing positions. In this article, we will explore the concept of a forex platform, discuss its importance, and delve into the key features that make a platform efficient and user-friendly.

The Role of a Forex Platform

A forex platform plays a crucial role in online trading, enabling traders to participate in the forex market from anywhere in the world. It provides a secure and user-friendly environment for executing trades, accessing real-time market data, and implementing trading strategies. With a forex platform, traders can monitor currency pairs, place buy or sell orders, set stop-loss and take-profit levels.

Key Features of a Forex Platform

1. User-Friendly Interface

A good forex platform should have an intuitive and user-friendly interface. It should be easy to navigate, with clearly labeled buttons and menus. Traders should be able to quickly access essential features and execute trades without any confusion.

2. Real-Time Market Data

A reliable forex platform provides real-time market data, including currency prices, charts, and technical indicators. It should offer live streaming quotes and allow traders to analyze price movements.

3. Order Execution

A forex platform should offer efficient order execution, allowing traders to enter and exit positions quickly and accurately. It should support different order types, such as market orders, limit orders, and stop orders, to accommodate various trading strategies.

4. Charting Tools and Technical Analysis

Advanced charting tools and technical analysis features are essential in a forex platform. Traders should have access to a wide range of chart types, timeframes, and technical indicators to analyze price patterns, identify trends, and make informed trading decisions.

5

User

continue

ChatGPT

. Risk Management Tools

Forex trading involves risk, and a robust forex platform should provide risk management tools to help traders mitigate potential losses. Features such as stop-loss orders, take-profit orders, and trailing stops enable traders to set predefined levels at which their positions will be automatically closed, limiting their exposure to unfavorable market movements.

6. Mobile Compatibility

In today’s fast-paced world, the ability to access the forex market on mobile devices is essential. A reliable forex platform should be compatible with smartphones and tablets, allowing traders to monitor their positions, execute trades, and stay updated with market conditions while on the go.

Choosing the Right Forex Platform

When selecting a forex platform, consider the following factors:

- Reliability and Security: Choose a platform that is reputable and offers a secure trading environment, including encrypted data transmission and robust authentication measures.

- Supported Instruments: Ensure that the platform supports a wide range of currency pairs and other financial instruments you intend to trade.

- Execution Speed: Look for a platform with fast and reliable order execution to avoid slippage and delays in trade execution.

- Customer Support: Consider the availability and responsiveness of customer support, as you may require assistance in case of technical issues or inquiries.

- Demo Account: Opt for a platform that offers a demo account to practice trading and familiarize yourself with the platform’s features before trading with real money.

Conclusion and Suggestions

A forex platform is a vital tool for traders, providing access to the global currency market and facilitating online trading. It offers a range of features and tools to execute trades, analyze market data, and manage positions effectively.

When selecting a forex platform, prioritize user-friendliness, real-time market data, efficient order execution, charting tools, risk management features, and mobile compatibility. Choose a platform that suits your trading style, offers reliable customer support, and provides a secure trading environment.

Remember to start with a demo account to familiarize yourself with the platform and practice trading strategies without risking real money. Continuously update your knowledge, adapt to market conditions, and always practice sound risk management principles in your trading activities.