When it comes to trading foreign currencies, the forex open market is a crucial concept for all traders to understand. In essence, the forex open market is the period when the majority of trading activities take place, and currencies are actively bought and sold. In this article, we will discuss what the Forex Open Market is, its various trading sessions, and how to make the most of these sessions to improve your trading strategy. Additionally, we’ll also look at some tools and resources to help you navigate the forex open market with ease.

The forex open market refers to the decentralized global market where currencies are traded around the clock, 24 hours a day, five days a week. It consists of a network of financial institutions, banks, brokers, and individual traders who exchange currencies at varying exchange rates.

Trading Sessions in the Forex Open Market

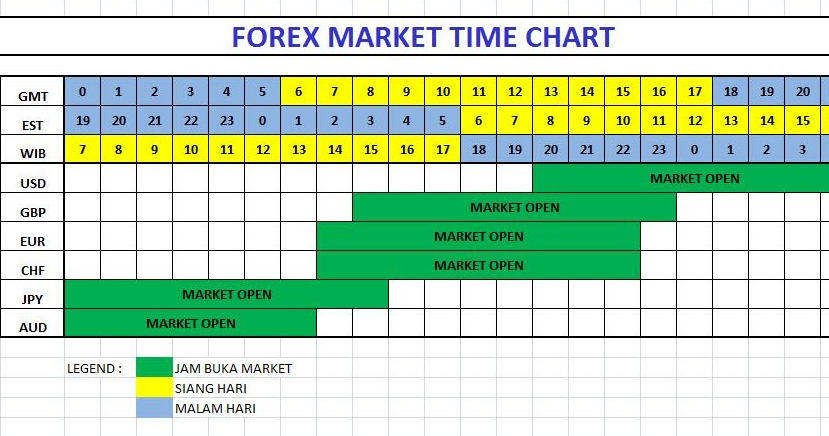

The forex open market is divided into four major trading sessions, each corresponding to the business hours of major financial centers around the world. These sessions are:

- Sydney session: This session corresponds to the business hours of the Australian market, running from 10 PM to 7 AM GMT.

- Tokyo session: Also known as the Asian session, running from 12 AM to 9 AM GMT.

- London session: This session corresponds to the business hours of the European market.

- New York session: Also known as the North American session, it corresponds to the business hours of the US market.

Strategies for Trading in the Forex Open Market

Each trading session in the forex open market offers opportunities and challenges, depending on the currencies being traded and the market conditions. To make the most of these sessions, consider implementing the following strategies:

- Understand the characteristics of each session: sessions have varying levels of liquidity, volatility, and trading opportunities. Familiarize yourself with the unique characteristics of each session to better tailor your trading approach.

- Trade during the overlap of sessions:The overlap of trading sessions often results in increased liquidity and volatility.

- Focus on specific currency pairs: Depending on the trading session, certain currency pairs may offer better trading opportunities. For instance, during the Tokyo session, you might want to focus on trading pairs involving the Japanese yen.

- Stay informed: Keep an eye on the economic calendar and important news events to anticipate potential market movements.

- Manage risk: Always use proper risk management techniques, such as setting stop-loss orders and using appropriate position sizes.

Tools and Resources for Navigating the Open Market

To help you navigate the open market more effectively, consider using the following tools and resources:

- Economic calendars: These calendars provide information on upcoming economic events and their potential impact on the forex market. Stay informed and use this information to adjust your trading strategy when necessary.

- Trading platforms: Choose a reliable and user-friendly trading platform that offers a wide range of tools, indicators.

- Market analysis: Utilize various forms of market analysis, such as technical, fundamental.

- Trading communities: Participate in online trading forums and communities to exchange ideas, learn from experienced traders.

Conclusion and Suggestions

Understanding the forex open market and its trading sessions is essential for all forex traders looking to maximize their trading opportunities and manage risks effectively. By familiarizing yourself with the unique characteristics of each trading session, implementing appropriate strategies, and using various tools and resources.

As a suggestion, always stay informed about the latest market developments and be prepared to adapt your trading strategy in response to changing market conditions. Additionally, never underestimate the importance of proper risk management to protect your trading capital in the unpredictable open market.