If you’re new to Forex trading, you might be wondering what “forex pairs” are. Simply put, a forex pair is a combination of two currencies that are traded against each other. For example, the EUR/USD forex pair is the euro against the US dollar. When you trade this pair, you’re betting on whether the euro will rise or fall against the US dollar.

Forex pair are used by Forex traders to speculate on the direction of the currency markets and make a profit. By buying or selling a currency pair, traders aim to profit from the changes in exchange rates between the two currencies. Forex trading is done through a broker, who provides the platform for traders to buy and sell currency pairs. It’s a highly liquid market, with trillions of dollars traded every day.

The Major Forex Pairs

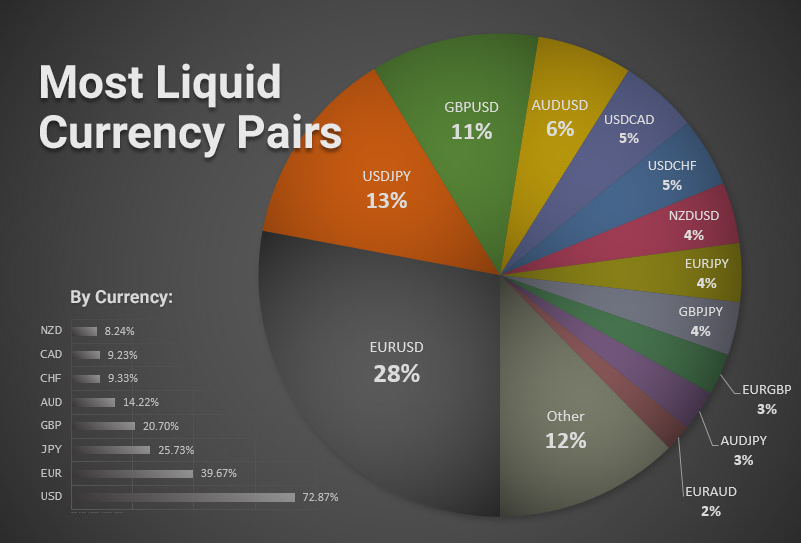

There are many currency pairs to choose from when trading Forex, but some are more popular than others. These are known as the “major” forex pair and they include:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

The major forex pair are considered to be the most liquid, with the highest trading volume and the narrowest spreads. This means that they are the easiest to trade and provide the best opportunities for profit. As a result, they are the most popular among Forex traders, especially among those who are just starting out.

The Minor Forex Pair

In addition to the major forex pair, there are also many “minor” forex pairs. These pairs are made up of less traded currencies and are considered to be less liquid than the major forex pair. Examples of minor forex pair include:

- EUR/GBP

- GBP/JPY

- EUR/CHF

- EUR/CAD

- AUD/JPY

Trading minor forex pair can be more challenging than trading the major forex pair. The spreads are wider, meaning that the cost of trading is higher, and the trading volumes are lower, meaning that it may be harder to enter and exit trades. However, minor forex pair can still provide opportunities for profit, especially for more experienced Forex traders who have a good understanding of the underlying market conditions.

Exotic Forex Pairs

In addition to the major and minor forex pair, there are also “exotic” forex pairs. These pairs are made up of a major currency and a currency from an emerging market, such as the Mexican peso or the South African rand. Examples of exotic forex pair include:

- USD/MXN

- EUR/TRY

- GBP/ZAR

- USD/THB

- EUR/PLN

Exotic forex pair are considered to be the least liquid and the most volatile of all the forex pair. The spreads are even wider than for the minor forex pair, and the trading volumes are much lower. This means that trading exotic forex pair can be risky, and it is not recommended for inexperienced Forex traders. However, for experienced traders who are familiar with the underlying market conditions, trading exotic forex pair can offer the potential for significant profit.

Conclusion and Suggestion

In conclusion, forex pairs are a combination of two currencies that are traded against each other. There are major, minor, and exotic forex pairs, each with their own unique characteristics and trading opportunities. When choosing which forex pair to trade, it’s important to consider your experience level, risk tolerance, and trading goals. If you’re just starting out, it’s recommended to stick with the major forex pairs, as they offer the best opportunities for profit with the least amount of risk. As you gain more experience, you can consider branching out into the minor and exotic forex pair, but be aware of the increased risk involved.

As with any type of investing, it’s important to do your own research and not to rely solely on this article for information. Make sure to educate yourself about Forex trading, the markets, and the different forex pair before making any trades. And always remember to trade responsibly and never risk more than you can afford to lose.