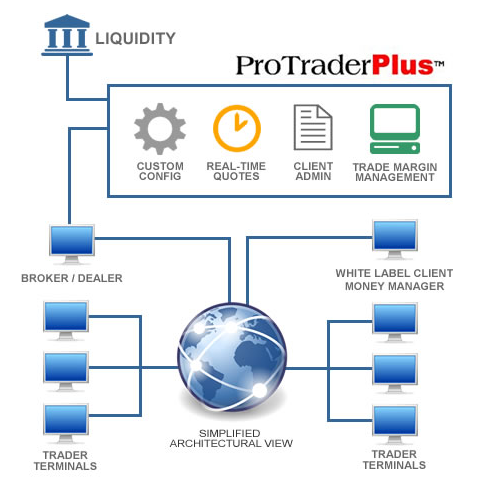

In the forex market, the term liquidity provider forex refers to the entity that provides market liquidity. This role is crucial because it impacts the efficiency and fluidity of the market. Liquidity providers (LPs) make it possible for traders to enter and exit trades by providing the necessary buying and selling volumes. But how does this work, and why is it essential? In this article, we’ll delve into the world of liquidity providers in forex.

Who are Liquidity Providers?

Liquidity provider forex typically refers to big banks, financial institutions, and hedge funds. These entities have substantial financial resources, allowing them to buy and sell large amounts of currency pairs, thus providing the necessary liquidity in the forex market.

How Liquidity Providers Operate

Liquidity providers operate by standing ready to buy or sell currency pairs. When a forex trader places a trade, the liquidity provider executes the trade at the best available price. The difference between the buy and sell price (the spread) constitutes the liquidity provider’s profit.

Importance of Liquidity Providers

Liquidity providers play a vital role in the forex market. Here’s why:

- They facilitate transactions: By providing liquidity, they ensure that traders can enter and exit trades whenever they want.

- They improve market efficiency: Their presence reduces the spread, which translates into lower transaction costs for traders.

- They provide market stability: In times of high volatility, they continue to buy and sell, ensuring the smooth operation of the market.

Conclusion

Understanding the role of a liquidity provider forex is crucial for any forex trader. They ensure the smooth functioning of the forex market, facilitating transactions, reducing transaction costs, and providing stability. The more liquidity providers in the market, the more competitive the spreads, which ultimately benefits the traders.

Suggestions

If you’re a forex trader, it’s essential to choose a broker with a robust network of liquidity providers. This will ensure that you get competitive spreads and can execute trades efficiently, even during periods of high volatility. Remember, a good understanding of the forex market, including the role of liquidity provider forex, is key to successful trading. Keep learning, keep trading, and good luck!