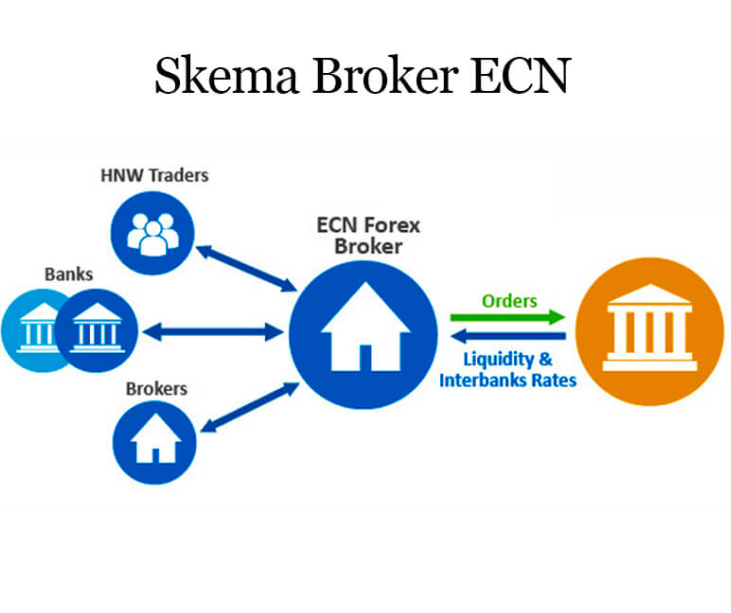

ECN Forex, which stands for Electronic Communication Network, is a type of trading system used in the foreign exchange

(Forex) market. It provides direct access to liquidity providers, such as banks, financial institutions, and other

traders, without the need for intermediaries. ECN Forex allows traders to interact with the market in a transparent

and efficient manner, offering the potential for better pricing and execution.

How ECN Forex is Used

Traders can utilize ECN in the following ways:

- Direct Market Access: With ECN, traders gain di rect access to the Forex market, where they can interact with

liquidity providers and other participants. This allows for faster trade execution and potentially better pricing

compared to traditional trading methods. - Tight Spreads: ECN typically offers tight spreads, which refers to the difference between the buying and

selling price of a currency pair. The competitive environment of the ECN system often results in lower spreads,

reducing trading costs for traders. - Depth of Market: ECN provides visibility into the depth of the market, allowing traders to see the available

liquidity at different price levels. This information can assist in making informed trading decisions. - Anonymous Trading: Traders using ECN can execute trades anonymously. This means that their orders are not

visible to other market participants, ensuring a level playing field and reducing the potential for price

manipulation. - Order Types and Strategies: ECN supports various order types, including market orders, limit orders, and

stop orders. Traders can employ trading strategies, such as scalping, hedging, and algorithmic trading,

within the ECN environment.

The Benefits of ECN Forex

Utilizing ECN offers several advantages for traders:

- Transparent Market: ECN provides transparency by di splaying real-time market data and order book

information. Traders can make more informed decisions based on actual market conditions. - Improved Execution: Through di rect market access, ECN allows for faster trade execution and potentially

better pricing. Traders can take advantage of market opportunities without delays caused by intermediaries. - No Conflict of Interest: ECN eliminates any conflict of interest between traders and brokers. Brokers do not

act as counterparties, reducing the potential for biased execution or manipulation. - Access to Deep Liquidity: With ECN, traders have access to a vast pool of liquidity from multiple sources,

increasing the chances of executing trades at desired prices. - Lower Trading Costs: ECN often offers lower trading costs compared to traditional trading methods. With tight spreads and competitive pricing, traders can minimize their expenses and maximize their potential profits.

Risks and Considerations

While ECN Forex provides numerous advantages, it’s important to be aware of the potential risks and considerations involved:

- Market Volatility: The Forex market can experience significant volatility, which may impact the execution of trades in ECN Forex. Traders should carefully manage their risk and employ appropriate risk management strategies.

- Variable Spreads: While ECN Forex generally offers tight spreads, they can also vary depending on market conditions. Traders should be prepared for potential fluctuations in spreads during highly volatile periods.

- Technical Requirements: Utilizing ECN may require specific technical infrastructure and stable internet connectivity. Traders should ensure they have a reliable trading platform and suitable hardware and software to support their trading activities.

- Learning Curve: ECN Forex involves a more advanced trading environment compared to traditional methods. Traders may need to acquire a deeper understanding of market dynamics and order execution processes to effectively navigate the ECN system.

Conclusion

ECN Forex, with its direct market access and transparency, provides traders with a powerful tool to participate in the Forex market. By utilizing ECN Forex, traders can benefit from tighter spreads, improved execution, and access to deep liquidity. However, it’s crucial to consider the potential risks and requirements associated with this trading method.

Suggestions for Utilizing ECN Forex Effectively

Here are some suggestions to optimize your experience with ECN Forex:

- Educate Yourself: Invest time in understanding the ECN Forex system, including order types, market depth, and execution processes.

- Choose a Reliable Broker: Select a reputable broker that offers a robust ECN Forex trading platform and reliable trade execution.

- Implement Risk Management: Develop and adhere to a risk management strategy to protect your capital and minimize potential losses.

- Monitor Market Conditions: Stay informed about market trends, news, and events that can impact Forex prices and volatility.

- Practice and Test: Before committing significant capital, practice trading with a demo account and test your strategies in different market conditions.