When it comes to forex trading, timing is crucial. The forex market operates 24 hours a day, five days a week, and understanding the market times is essential for traders. Forex market times refer to the specific hours during which the forex market in di fferent regions around the world is most active. In this article, we will delve into the importance of forex market times and how they can impact your trading strategies and outcomes.

The Different Forex Market Sessions

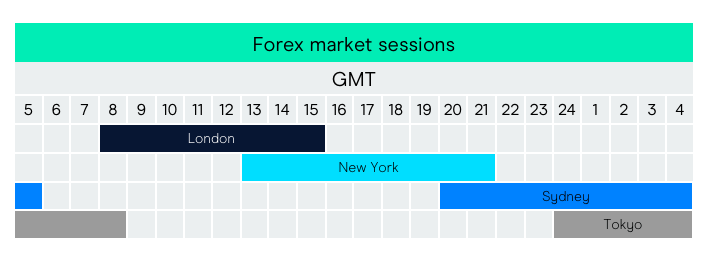

The forex market is divided into several sessions that overlap with each other, creating optimal trading opportunities throughout the day. Let’s explore the major forex market sessions:

1. Asian Session

The Asian session starts in the early hours of the morning in Asia and includes financial centers such as Tokyo, Hong Kong, and Singapore. This session sets the tone for the trading day, and currency pairs involving the Japanese yen, Australian dollar, and New Zealand dollar are often most active during this time. Traders focusing on these currency pairs may find the Asian session particularly important to monitor.

2. European Session

The European session is the most active session in the forex market. It overlaps with the Asian session for a few hours and includes major financial centers such as London, Frankfurt, and Paris. During this session, currency pairs involving the euro, British pound, and Swiss franc experience higher volatility and trading volume. Many traders prefer to focus on the European session due to its liquidity and market-moving potential.

3. American Session

The American session, also known as the New York session, is the final major session of the day. It overlaps with the European session for a few hours and includes financial centers such as New York and Toronto. Currency pairs involving the US dollar, such as EUR/USD and USD/JPY, tend to be most active during this session. Economic news releases from the United States can also greatly impact the forex market during the American session.

Optimizing Your Trading Based on Market Times

Understanding forex market times is crucial for optimizing your trading strategies and maximizing your potential profits. Here are some key considerations when it comes to optimizing your trading based on market times:

1. Overlapping Sessions

During the overlapping periods between sessions, there is increased market activity and liquidity. For example, the overlap between the European and American sessions creates a high-volume trading environment. This is often the best time to trade, as there is greater price movement and more opportunities to capitalize on market fluctuations.

2. Volatility and Liquidity

Different market times exhibit varying levels of volatility and liquidity. Volatility refers to the extent of price movements, while liquidity refers to the ease of executing trades. The European session tends to have higher volatility and liquidity, making it attractive to traders who thrive on fast-paced, active markets. On the other hand, the Asian session may be less volatile, but it can still present opportunities for specific currency pairs.

3. Economic News Releases

Economic news releases, such as interest rate decisions, employment reports, and GDP announcements, can significantly impact currency movements. It’s important to be aware of the forex market times when these news releases occur, as they can lead to increased volatility and sudden price shifts. Traders often pay close attention to economic events during the overlapping periods between sessions, when the market is most active.

Conclusion

Understanding forex market times and their implications is crucial for successful trading. By being aware of the different market sessions and their characteristics, you can optimize your trading strategies and take advantage of the most favorable trading conditions. Remember to consider overlapping sessions, volatility and liquidity, and the impact of economic news releases. By aligning your trading activities with the appropriate market times, you can increase your chances of making profitable trades.

Suggestion

To make the most of forex market times, it is recommended to develop a trading plan that aligns with your preferred sessions. Determine which market sessions best suit your trading style, whether it’s the high volatility of the European session or the specific currency movements during the Asian session. Additionally, stay informed about economic events and news releases that can impact the market. Consider using economic calendars and news sources to keep track of important announcements. By staying disciplined, well-informed, and adaptable to market conditions, you can optimize your trading performance during different forex market times.