If you live in Maryland and own a car, you need to have car insurance. But with so many insurance companies and options available, it can be difficult to know where to start when it comes to finding the best coverage at an affordable price. That’s why it’s important to compare car insurance rates Maryland before making a decision.

Compare Car Insurance Rates Maryland

In this article, we’ll go over what you need to know about car insurance in Maryland and how to compare rates from different insurance companies to find the best coverage for you.

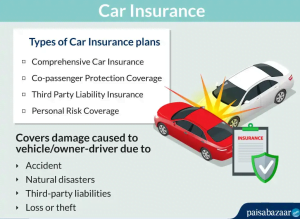

What is car insurance?

Car insurance is a type of insurance policy that provides financial protection for you and others in case of a car accident or any other mishap. In Maryland, all drivers are required to have at least the minimum required insurance coverage, which includes:

- Liability insurance

- Personal injury protection (PIP) insurance

What to consider when comparing car insurance rates in Maryland

When comparing car insurance rates in Maryland, there are several factors you should consider to find the best coverage for you. These factors include:

- Your driving record

- The type of car you drive

- Your age and gender

- The coverage limits you need

Your driving record is one of the most important factors in determining your insurance rate. If you have a good driving record, you’re likely to get a better insurance rate. The type of car you drive is also important, as certain cars are more expensive to insure than others.

How to compare car insurance rates in Maryland

To compare car insurance rates in Maryland, you can use an online quote comparison tool, talk to an insurance agent, or ask friends and family for recommendations. Using an online quote comparison tool is a quick and easy way to get quotes from several different insurance providers. Asking friends and family for recommendations can also be a good way to find a reliable insurance provider in Maryland.

Conclusion

In conclusion, comparing car insurance rates in Maryland is a crucial step in finding the best coverage at an affordable price. By understanding the basics of car insurance, what to consider when comparing rates, you can ensure that you have the right coverage at a price you can afford. Don’t hesitate to compare rates from several insurance providers to find the best coverage for you.

Suggestion

It’s important to regularly review your car insurance coverage and make changes if necessary. Life changes such as getting married, having a child, or buying a new car can all impact your insurance needs, so it’s important to reevaluate your coverage every year to make sure you have the right coverage for your current needs. So, what are you waiting for? Start comparing car insurance rates in Maryland today and find the best coverage for you!