Car Insurance Quote in Wisconsin, and it’s important to have adequate coverage to protect yourself and your car in the event of an accident. In Wisconsin, car insurance policies must include liability coverage, which covers damages and injuries to others in the event of an accident that you are found to be at fault for.

Getting a Car Insurance Quote in Wisconsin

If you’re in the market for car insurance in Wisconsin, there are several ways to get a quote:

- Online: Many insurance providers offer online quote tools that allow you to enter your information and get a quote quickly.

- Over the Phone: You can also call insurance providers directly to get a quote over the phone.

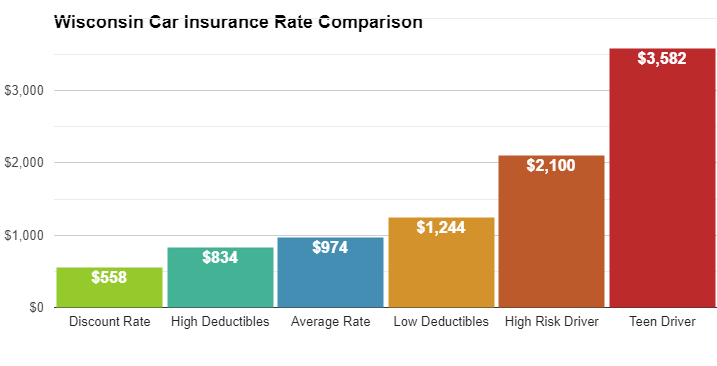

Factors that Affect Car Insurance Rates in Wisconsin

Several factors can impact car insurance rates in Wisconsin:

- Driving Record: Drivers with a clean driving record may be eligible for lower rates.

- Age: Younger drivers may pay higher premiums than older drivers, as they are considered to be at a higher risk of accidents.

- Car Make and Model: Certain cars may be more expensive to insure than others, depending on their safety ratings.

- Location: The location where the car is primarily driven can also impact car insurance rates in Wisconsin. Drivers in areas with higher rates of accidents or auto theft may pay more for insurance.

Conclusion and Suggestion

Getting a car insurance quote is an important step in protecting yourself and your car on the road. By understanding the factors that can impact car insurance rates and shopping around for quotes from multiple providers.

However, it’s important to make sure you have adequate coverage to protect yourself. Be sure to review your policy regularly and communicate openly with your insurance provider to ensure you have the right coverage for your needs.