If you are a driver in Oklahoma, it is important to have car insurance. Not only is it a legal requirement, but it can also protect you financially in case of an accident. However, car insurance can be expensive, and it can be tough to find affordable options. In this article, we will explore how to find Cheap Liability Car Insurance Oklahoma and what you need to know about this type of coverage.

Understanding Liability Car Insurance

Liability car insurance is the minimum coverage required by law in Oklahoma. This type of insurance covers the costs of damages and injuries that you may cause to others in an accident. Liability insurance does not cover your own damages or injuries. It is important to note that while liability insurance is the minimum required coverage, it may not provide enough protection in case of a serious accident. Consider purchasing additional coverage to ensure you are fully protected.

How to Find Cheap Liability Car Insurance in Oklahoma

While car insurance can be expensive, there are ways to find affordable liability coverage in Oklahoma. Here are some tips:

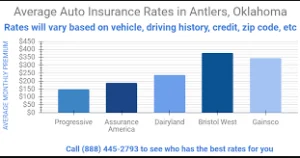

- Shop around and compare rates from multiple insurance providers. Each provider uses di fferent factors to determine your rates, so it pays to shop around.

- Consider raising your deductible. A higher deductible can lower your monthly premiums, but keep in mind that you will need to pay this amount out of pocket if you get into an accident.

- Take advantage of discounts. Many insurance providers offer for safe driving habits, multiple cars on one policy, and more.

- Consider bundling your car insurance with other types of insurance, such as homeowners or renters insurance. This can often lead to a discount.

The Risks of Driving Without Insurance

Driving without car insurance in Oklahoma is illegal and can result in fines and other penalties. Additionally, if you cause an accident without insurance, you could be held financially responsible for any damages or injuries you cause. This can be incredibly expensive and could have long-term consequences for your finances. Always ensure that you have the minimum required car insurance coverage in Oklahoma.

Conclusion and Suggestions

Car insurance is a necessary expense for drivers in Oklahoma. While liability car insurance is the minimum required by law, it may not provide enough protection in case of a serious accident. It is always a good idea to consider purchasing additional coverage. To find affordable car insurance in Oklahoma, shop around, raise your deductible, take advantage of discounts, and consider bundling your insurance policies. Driving without insurance is illegal and can have serious financial consequences. Make sure to always have the minimum required car insurance coverage in Oklahoma.